President Biden on Friday introduced that some scholar mortgage debtors enrolled within the Saving on Invaluable Training (SAVE) plan can have their remaining money owed zeroed out subsequent month. The plan, which Republicans say will see taxpayers foot the invoice, ...

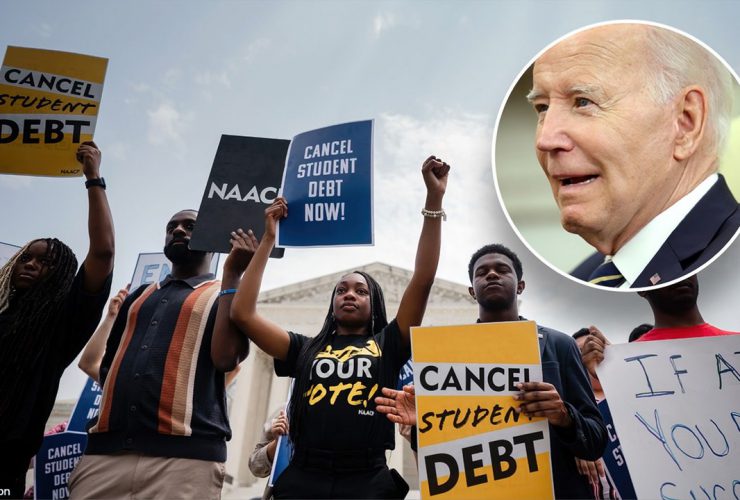

Student loan borrowers are anxiously awaiting the Supreme Court¡¯s decision on whether President Biden¡¯s student loan forgiveness plan will stand, and the ruling could drop as early as Thursday.? The high court is currently weighing whether the Biden administration can ...

During the week of August 7, 2024, average private student loan rates rose for borrowers with credit scores of 720 or higher who used the Credible marketplace to take out 10-year fixed-rate loans and dropped for 5-year variable-rate loans. Through ...

The Biden administration announced Wednesday that an additional 125,000 student loan borrowers would receive a portion of $9 billion in additional debt forgiveness. The relief comes through fixes the administration made to income-driven repayment (IDR) and Public Service Loan Forgiveness, ...

During the week of July 24, 2024, average private student loan rates rose for borrowers with credit scores of 720 or higher who used the Credible marketplace to take out 10-year fixed-rate loans and 5-year variable-rate loans. Through Credible, you ...

As tens of millions of scholar mortgage debtors put together to make their first scholar mortgage funds in October after a three-year federal pause, scammers are fraudulently providing compensation help and even scholar mortgage forgiveness.?? The truth is, the Federal ...

After finding legal loopholes around the Supreme Court¡¯s student loan decision, one personal finance expert unveiled what the Biden administration isn¡¯t broadcasting about its new repayment plan. “They’re really pulling the wool over people’s eyes because they go, ‘oh, there’s ...

A federal appeals court blocked President Biden’s administration from implementing rules aimed at providing debt relief to student loan borrowers who were misled by their colleges Monday. The ruling from the 5th Circuit Court of Appeals is the latest defeat ...

Through the week of Oct. 30, 2024, common non-public pupil mortgage charges fell for debtors with credit score scores of 720 or greater who used the Credible market to take out 10-year fixed-rate loans and rose for 5-year variable-rate loans. ...

Through the week of Oct. 2, 2024, common non-public pupil mortgage charges rose for debtors with credit score scores of 720 or increased who used the Credible market to take out 10-year fixed-rate loans, and plummeted for 5-year variable-rate loans. ...