The way that you handle credit can have a significant impact on your future eligibility for loans or credit cards. That¡¯s because, in the UK, credit reference agencies keep track of consumer financial histories. Lenders are provided with data to ...

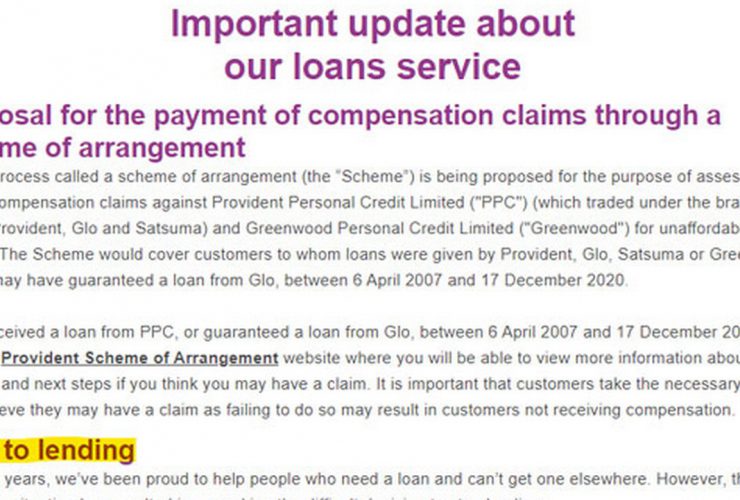

UPDATE 18 December 2021: Provident has confirmed that it’s fully closing its doorstep lending enterprise (Provident Private Credit score) on thirty first December 2021. When you have any debt with Provident at this level will probably be written off fully ...

The COVID-19 pandemic has dealt a extreme blow to the UK economic system with unemployment numbers reported at 4.8% for the interval between January 2021 – March 2021. With such a depressed economic system, the variety of debtors particularly these ...

All people is aware of that betting includes a sure diploma of threat whether or not you guess on sport, actuality TV exhibits, and even the Oscars. The end result could both be in your favour the place you win ...

On April 14, 2021, Bitcoin made headlines for being the primary and solely cryptocurrency to hit $65,000 per unit. Viewing this crypto rally by means of the 2010 lens, when the primary crypto investor determined to promote their Bitcoin holdings, ...

Two years ago, a case against credit card firm Mastercard for imposing excessive card transaction charges was thrown out of the Competition Appeal Tribunal. However, in April this year the Court of Appeal decided that the Competition Appeal Tribunal must ...

Buying a car, whether new or second hand, comes with a range of responsibilities. One of the most important of these is ensuring that the car is regularly serviced and that any necessary repairs are carried out. This can be ...

New research shows that the difference between actual and advertised lending rates has widened significantly. Since 2011, the discrepancy between what lenders advertise as loan rates to consumers, and what borrowers actually pay, has increased from 1% to 3%. This ...

UPDATED 29/9/21: Since this text was revealed an extra 12 UK vitality corporations have gone bust affecting a further 2.0 million folks. It’s feared that dozens extra might fold over the approaching months as a result of they’ve did not ...

The web: a lurking power guzzler that’s threatening to bankrupt the planet. Because the world turns into extra depending on the web sphere, the web¡¯s insatiable starvation for power continues to skyrocket, posing a grave hazard to the surroundings. Stunning ...