FedNow is a brand new immediate cost service launched by the Federal Reserve in July 2023. Utilizing the FedNow Service, monetary establishments may give clients real-time cost capabilities, executing transactions in a matter of seconds even exterior of regular banking ...

First Republic Financial institution (FRB) turned the second-largest financial institution failure in U.S. historical past on Could 1, 2023, with most of its enterprise offered to JPMorgan Chase after federal regulators seized it. The financial institution suffered from a run ...

Retail Banking vs. Corporate Banking: An Overview Retail banking?is a bank's services that deal directly with consumers, while corporate banking is the part of the banking industry that serves business or corporate customers. Retail banking is the face of banking ...

What Is ChexSystems? ChexSystems is a consumer credit reporting agency that tracks activity related to closed checking, savings, and other deposit accounts at banks and credit unions. If you¡¯ve ever had issues with a deposit account, such as a bounced ...

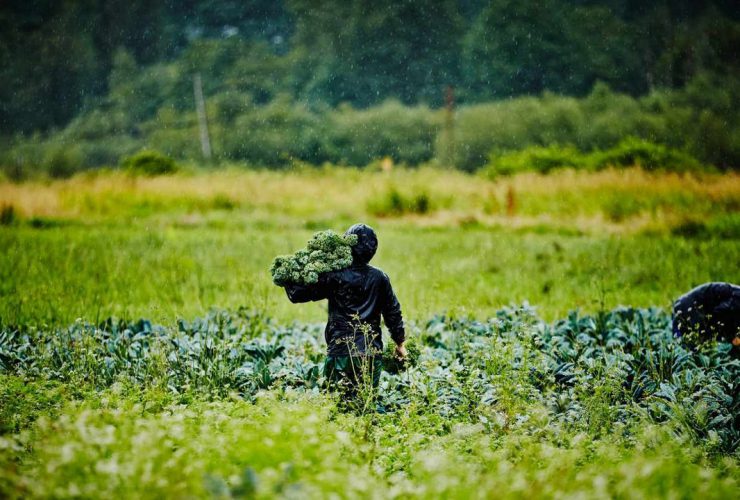

Banking as a newcomer to a rustic might be an extremely overwhelming endeavor. Regardless of being a nation based on immigrants, the USA could make issues troublesome for each documented and undocumented immigrants to succeed. Fortunately, immigrants¡ªtogether with these with ...

Early Warning Providers LLC, a privately held monetary know-how (fintech) firm owned by seven main banks, owns a number of firms together with Zelle, a cash switch app. It additionally offers id, authentication, and fee options for banks, governments, and ...

What Is a Depository? The term depository can refer to a facility in which something is deposited for storage or safeguarding, or an institution that accepts currency deposits from customers, such as a bank or a savings association. A depository ...

What Is a Bank Statement? A bank statement summarizes all the account’s monthly transactions and is typically sent by the bank to the account holder every month in paper or digital form. Bank statements contain checking and savings account information, ...

What Is a Demand Deposit? A demand deposit account (DDA) is a bank account from which deposited funds can be withdrawn at any time, without advance notice. DDA accounts can pay interest on the deposited funds but aren¡¯t required to. ...

Best 3-Month CD Rate: TotalDirectBank ¨C 5.51% APY Early-withdrawal penalty: 1 month of interest Minimum opening deposit: $25,000 About: TotalDirectBank is an online-only operation of City National Bank of Florida, established in Miami in 1946. Today, it has over $22 ...