Thousands and thousands of debtors with current scholar loans nonetheless haven’t made a fee because the payments resumed in October after a three-year hiatus, and a few admit they’re refusing to pay out of protest. In an Clever.com survey carried out this month of 1,000 federal scholar mortgage debtors, 25% stated that they had not made any funds in any respect, and 9% of these stated they have been holding off on paying their payments deliberately in an effort to strain the federal government into canceling their money owed. Of the almost 1 in 10 delinquent debtors collaborating on this “boycott” of scholar mortgage repayments, 44% stated they consider their protest will result in the cancellation of some federal scholar mortgage debt, and 28% suppose it’s “possible” the boycott will persuade the federal government to cancel all scholar mortgage debt, the survey discovered. However even when no additional debt cancellation comes from the boycott, a lot of the protesting debtors consider their efforts will make an influence.? BIDEN ANNOUNCES PLAN TO BAIL OUT STUDENTS FOR LOAN DEBTS UNDER $12K Eight-six % instructed Intelligence.com it’s “very” (45%) or “considerably possible” (41%) that the boycott will draw consideration to the scholar mortgage debt dialog. Sixty-four % stated they consider it’s “extremely” (32%) or “considerably possible” (18%) that the boycott will assist elect political candidates who consider in mortgage forgiveness. Monetary consultants advise in opposition to lacking scholar mortgage funds for any motive. “Though the frustration behind the scholar mortgage boycott is comprehensible, it¡¯s unlikely to result in optimistic change,” DebtHammer founder and CEO Jake Hill instructed the outlet. “As a substitute, it is going to destroy the credit score scores of those that select to take part. This will not seem to be a significant challenge within the brief time period, however failing to pay your scholar loans could make it tougher to acquire funding for future purchases.” BIDEN RENEWS ¡®KEEP GOING¡¯ CALL ON COLLEGE DEBT HANDOUTS The overwhelming majority, 69%, of debtors who nonetheless haven’t resumed their mortgage funds stated they haven’t paid the payments as a result of they can’t afford to. One other 18% stated they plan to carry off till September 2024 to renew paying as a result of that’s when extra extreme penalties for lacking funds kick in. Of the debtors who’ve resumed making their funds, 94% instructed Clever that doing so has been financially difficult. Many debtors had excessive hopes that their loans can be worn out by President Biden’s mortgage forgiveness plan to erase as much as $20,000 in debt per borrower, however the Supreme Courtroom struck it down final yr. GET FOX BUSINESS ON THE GO BY CLICKING HERE Since then, the White Home has introduced different efforts to scale back scholar mortgage debt, together with erasing $127 billion of debt owed by about 3.6 million debtors. FOX Enterprise’ Megan Henney contributed to this report.

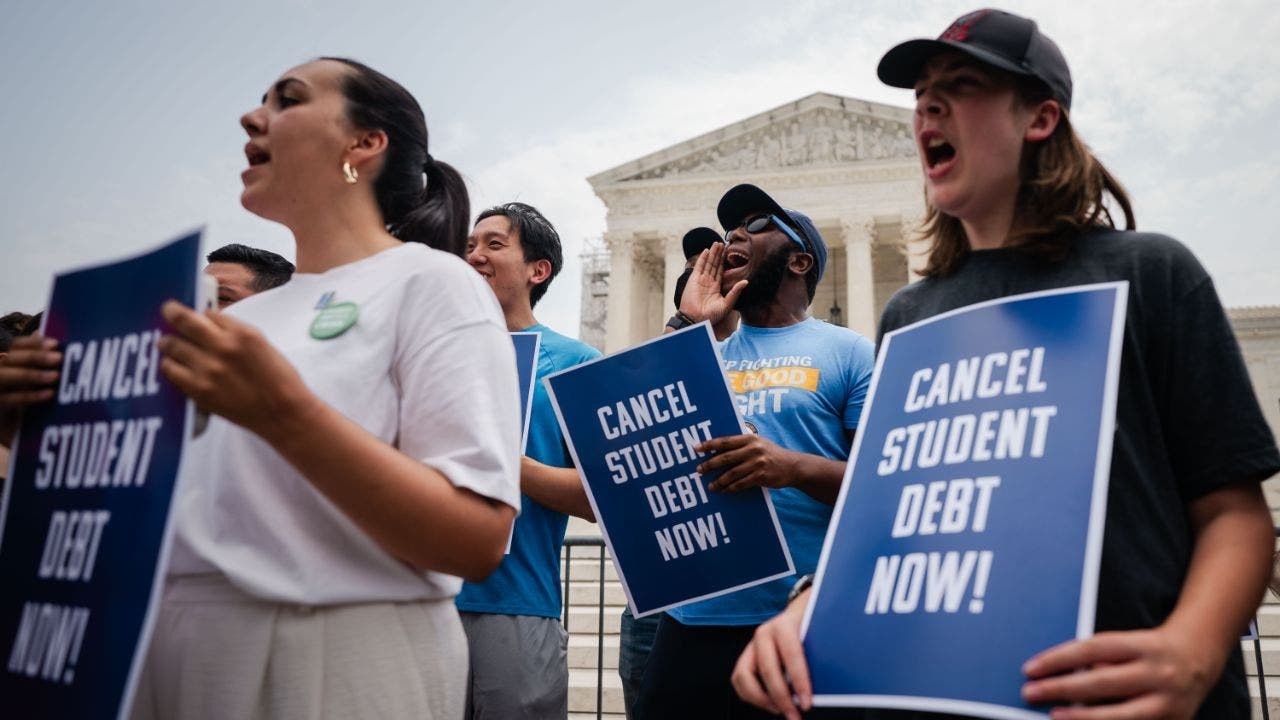

Some scholar mortgage debtors refusing to pay out of protest

Leave a Reply