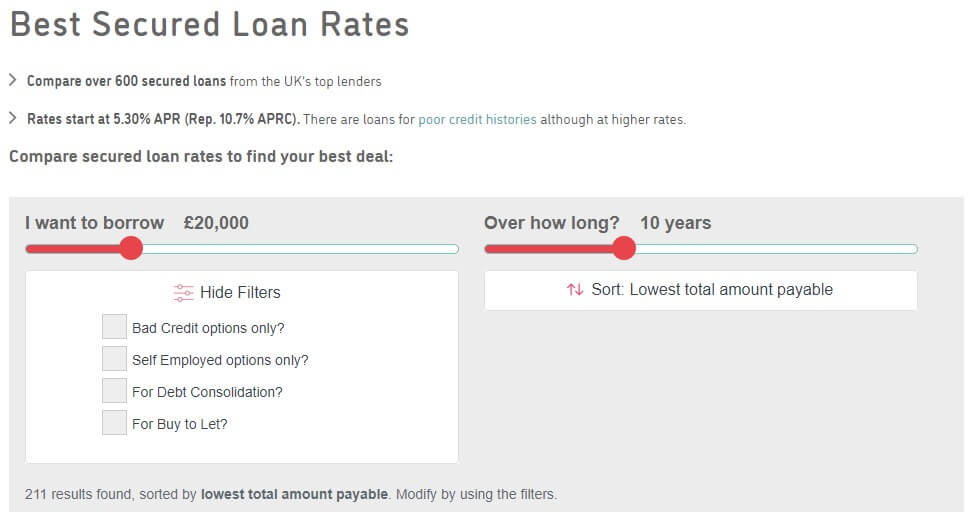

We’ve up to date our well-liked best-buy secured mortgage product desk to make it even simpler to seek out the exact mortgage that you really want. We’ve got over 600 mortgage merchandise supplied by quite a few lenders however many of those and even most of those gained’t fit your necessities. So, we’ve devised a means so that you can drill down into the outcomes. Having set your most popular mortgage values and borrowing interval you possibly can then modify the outcomes by utilizing 4 new filters:

- Low credit choices solely? In case your credit score historical past isn’t good then you possibly can select to incorporate solely these mortgage merchandise that you just stand one of the best probability of being accepted for. Remember that nowadays lenders are able to pricing their loans on a dynamic foundation so some merchandise which are outlined as “good credit score” should still be capable to accommodate you even when your circumstances aren’t good.

- Self-employed solely? In the event you work for your self and so don’t have a daily month-to-month revenue or it varies extensively from month to month you then’ll already know that many credit score suppliers will penalise you. Nevertheless, some merchandise can give you the results you want and others which are tailor-made particularly on your wants.

- For Debt Consolidation? Secured loans are sometimes utilized by debtors to consolidate their unsecured debt (bank cards, private loans, and so forth) to make month-to-month repayments extra reasonably priced. However lenders will generally create merchandise that don’t enable this and with our new filtering you possibly can take away these from the record.

- For Purchase to Let? In the event you already personal a rental property, don’t need to remortgage for one motive or one other however need to lengthen your borrowing (in opposition to the rising worth of the property) then a secured mortgage is another choice. Once more, not all lenders are ready to lend for this objective so this filter possibility permits you to contemplate solely people who do.

Lastly, it’s potential to use many filters on the identical time. So as an illustration in case you have a unfavorable credit ratings historical past and desire a mortgage for debt consolidation functions then you possibly can filter exactly to those necessities.

Replace! Charges are falling, so attempt our new filterable comparability desk that’s up to date in actual time.

Leave a Reply