Ever since the founding of the Bank of North America in 1781, banking has played a critical role in facilitating the American Dream. These institutions provide indispensable monetary services, ranging from accepting deposits to offering loans. Credit is king in the United States, and without high-quality financial institutions, countless Americans would struggle to acquire vehicles, housing, and other essential items.

However, like pretty much all of the nation¡¯s older institutions, banks have also played a significant part in America¡¯s racist past. Racial discrimination in the banking industry and financial system has targeted African Americans, and challenges to ending discrimination persist today. Black-owned banks arose as an alternative to larger institutions, to provide greater access to banking services as well as an opportunity to support local communities.

According to the Federal Deposit Insurance Corp. (FDIC), a minority depository institution (MDI) is ¡°…a federal insured depository institution for which (1) 51 percent or more of the voting stock is owned by minority individuals; or (2) a majority of the board of directors is minority and the community that the institution serves is predominantly minority. Ownership must be by U.S. citizens or permanent legal U.S. residents to be counted in determining minority ownership.¡± Of the 22 Black-owned banks featured in this article, four fall into the latter category.

For the purposes of this article, Black-owned and Black-managed credit unions that serve the Black community have been included to provide the most complete picture of America¡¯s Black financial institutions. The article uses the term ¡°Black-owned¡± in this broad sense, recognizing that stockholders own for-profit banks and members own credit unions.

Key Takeaways

- Today there are 148 minority-owned financial institutions in the United States. Taken together, they have approximately $343 billion in assets in total.

- Of these, 22 are Black-owned banks.

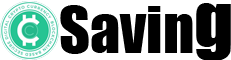

- Black-owned banks provide customers not only access to the financial resources they need but also the chance to invest in the financial health and well-being of their community.

- Black-owned banks also play a critical role in fighting modern-day systemic racism in the financial sector.

- Critics of Black-owned for-profit banks have posited that true financial justice requires institutions, such as not-for-profit credit unions, that are separate from a financial system rooted in racism and exploitation.

Background and History of Black-Owned Banks

Black-owned banks didn¡¯t exist until more than a century after the Bank of North America first opened its doors. Prior to the chartering of the first Black-owned bank in 1888, the U.S. Congress and then-President Abraham Lincoln established Freedman¡¯s Savings Bank in 1865. As part of the Freedman¡¯s Bureau, this institution was designed to help newly freed African Americans navigate the U.S. financial system.

Despite Congress voting to close the Freedman¡¯s Bureau in 1872, the bank continued to operate. In 1874, Frederick Douglass took over as the bank¡¯s Washington, D.C., branch director, and he found the place to be rife with corruption and risky investments. Despite Douglass investing $10,000 of his own money in the bank in an attempt to save it, Freedman¡¯s Savings went bankrupt later that same year. Although Freedman¡¯s Savings Bank doesn¡¯t fit the modern criteria of a Black-owned bank, it represents a critical first step.

The first officially chartered Black-owned bank, True Reformers Bank, was founded on March 2, 1888, by the Rev. William Washington Browne. A former slave and Union Army officer, Browne was founder of the Grand Fountain United Order of True Reformers fraternal organization. True Reformers Bank came about when Browne and his organization faced financial hardships while trying to establish a new branch in Virginia. Unable to manage the order¡¯s money without arousing suspicion from paranoid and prejudiced locals, Browne founded True Reformers Bank so that the organization¡¯s finances would be free of scrutiny from White people.

The bank opened its doors in 1889 and went from a small operation in Browne¡¯s house to an institution strong enough to survive the financial panic of 1893. Although True Reformers Bank continued to operate after Browne¡¯s death in 1897, problems were beginning to develop by 1900. Under its new president, the Rev. William Lee Taylor, branches were poorly regulated, unsecured loans were made, and an embezzlement scandal cost most accountholders their savings. By 1910, the State Corporation Commission had ordered the bank to be closed.

As the story of True Reformers Bank was playing out, other Black-owned banks were also getting their start in the U.S. Capital (spelled Capitol by some accounts) Savings Bank of Washington, D.C., opened its doors in Oct. 1888, roughly six months before True Reformers Bank. Capital Savings also managed to survive the financial panic of 1893, though it later closed in 1902.

From 1888 to 1934, more than 134 Black-owned financial institutions were founded, predominantly located in Southern states. Their numbers dwindled during the Great Depression, leaving nine by 1930. It wasn¡¯t until the civil rights movement that a resurgence took place, raising their numbers to 50 by 1976.

By 1988, the savings and loan crisis had wiped out 35 Black-owned banks. The start of the most recent decline came in 2001, during the early 2000s recession, which rapidly accelerated once the Great Recession began. There are 44 Black-owned financial institutions, including credit unions, left today.

¡°You can¡¯t separate Black history from American history,¡± says Tyrone Ross, chief executive officer (CEO) of Onramp Invest, a crypto asset integration platform solution for financial advisors. ¡°We¡¯ve always been well adept and versed in financial education and the ability to be entrepreneurs. It¡¯s just been stripped from us. So it¡¯s OK to write these articles¡ªor have panels or whatever¡ªbut let¡¯s start with the history first so people go, ¡®Oh, crap. It really was stripped from them, and they¡¯re just trying to get it back.¡¯¡±

Modern-Day Discrimination

As recently as 2023, the wealth of a White family was more than six times higher on average than that of a Black family. This is a result of inequality, discrimination, racism, and differences in power and opportunity compounding throughout America¡¯s history. It also is why the diminishing number of Black-owned banks is especially of concern, given the role that these institutions play in fighting modern-day systemic racism in the financial sector.

Consider redlining. This unethical and now-illegal practice is used to block off access to important services for residents of certain neighborhoods based on their race or ethnicity. The Civil Rights Act of 1964, which prohibits discrimination on the basis of race, color, religion, sex, and national origin, was a start. And yet, although the Fair Housing Act of 1968 and the Community Reinvestment Act (CRA) of 1977 were both intended to eliminate redlining, this kind of discrimination is still seen today.

For instance, 68.1% of loans made from 2012 to 2018 for housing purchases in Chicago went to predominantly White areas; 8.1% went to predominantly Black areas. Banks also lent more money to predominantly White neighborhoods than to every predominantly Black neighborhood combined. This disparity is even starker when looking at individual lenders, with JPMorgan Chase lending 41 times more money in White neighborhoods than Black ones.

Chicago is far from the only place where redlining occurs. From 2015 to 2020, the denial rate for Black home loan applications in Boston was 15.3%, more than three times that of their White counterparts. And in 2018, people of color in 61 cities were more likely to be denied home loans than White residents. If homeowners aren¡¯t moving into¡ªand investing in¡ªa neighborhood, then it means capital isn¡¯t flowing into the community, which leads to poverty and crime having an inescapable presence in the area.

¡°One in five Black Americans now is unbanked. When you look at our poverty rates, our lack of ownership, lack of homeownership, that all goes back to economic empowerment,¡± Ross explains. ¡°Economic empowerment starts with banking.¡±

Investopedia / Lara Antal

The Importance of Black-Owned Banks

To understand why Black-owned banks matter, it¡¯s critical to recognize the role that banks play in financial life. A common service that banks provide is access to a checking account, allowing for the safe storage of an individual¡¯s funds, typically in exchange for a minimal fee. In addition to accepting monetary deposits, banks also furnish loans for both individuals and businesses looking to finance crucial purchases. Banks also offer mortgages for real estate purchases. Many banks issue credit cards, which are valuable tools for building the credit history necessary to receive most loans.

Outside of providing financial services, a number of banks have also launched programs on financial literacy for low- and moderate-income communities. It¡¯s difficult, if not impossible, to imagine thriving in the modern economy without taking advantage of the aid that a bank can provide. And if access to these types of services is constantly denied to certain groups, then it¡¯s easy to see how these groups may face more financial difficulties than others.

Black-owned banks offer an alternative for residents who have been consistently discriminated against by other financial institutions. They have typically provided more money to borrowers living in low- and moderate-income census tracts than other banks. Black-owned banks also are more willing to tolerate higher levels of risk than alternative institutions. Our research found that in 2016, 67% of mortgages made by Black-owned banks were either Federal Housing Administration (FHA) mortgages¡ªwhich typically serve riskier borrowers¡ªor mortgages held ¡°in portfolio,¡± meaning they are liable to the risk of the borrower defaulting.

Additionally, Black-owned banks tend to focus their lending on small businesses, nonprofits, and Black homebuyers. As of 2018, all Black-owned banks were community banks; these institutions are dedicated to supporting the economies of the communities that they serve. Even during difficult times, Black-owned banks have stuck by their customers. During the 2007¨C2008 financial crisis, despite a 69% drop in all mortgage lending to Black borrowers, the number of mortgages that Black-owned banks provided rose 57%.

¡°So there¡¯s lack of lending, there¡¯s lack of funding, there¡¯s lack of access to the ability to acquire assets and build wealth,¡± Ross says. ¡°The Black community has for years been afraid of banking with traditional institutions. A lot of them live in banking deserts where there are no banks, which is also why you have credit unions, check-cashing places, and payday loans.¡±

Without Black-owned banks, countless vulnerable consumers could be forced to rely on high-interest loans from pawnshops and payday lenders for their financing. What¡¯s more, Black-owned banks provide customers not only access to the financial resources they need but also the chance to invest in the financial health and well-being of their community and fellow Americans.

¡°I think we have a responsibility now to realize that¡ªif you really want to be grassroots, and you really want to help Black Americans¡ªget that money in Black banks and then have those Black banks fund the people,¡± Ross says.

A different book, Black Metropolis: A Study of Negro Life in a Northern City, published in 1945 by two American sociologists is considered a foundational work on the subject of African American sociology and cultural studies. It influenced generations of scholars and activists and is a key resource for investigating the impact of redlining, racial bias in medical-care decision-making tools, and the history of lending discrimination in the United States.

Other Alternatives for Community Funding

Not everyone sees Black-owned, for-profit banks as the solution. Critics argue that true financial justice requires institutions that are entirely separate from a financial system rooted in racism and exploitation.

¡°I¡¯ve been very critical of for-profit Black banks and the capitalist logic that governs them,¡± says Professor Guy Mount, assistant professor at Wake Forest University. ¡°In my opinion, member-owned credit unions and nonprofit co-ops are the way forward for Black communities hoping to not only survive within capitalism, but build a viable Black economic alternative to it.¡±

In fact, that choice is currently available to consumers. Of the Black-owned financial institutions in the U.S.¡ªall listed below¡ªmany are credit unions.

Other critics have taken this concept further. In The Color of Money: Black Banks and the Racial Wealth Gap, Mehrsa Baradaran, professor of law at the University of California Irvine School of Law, posits that those in power have pushed the idea of Black-owned banks as a diversionary tactic whenever the African American community demanded more direct solutions to the racial wealth gap. For instance, although Freedman¡¯s Bank remains a critical facet of Black history, the Freedman¡¯s Bureau originally proposed providing newly freed slaves with an allotment of land¡ªthey received a bank instead.

More recently, when civil rights leaders began calling for a redistribution of wealth, then-President Richard Nixon co-opted the rhetoric of that same movement to create a civil rights platform centered around ¡°Black capitalism.¡± He wasn¡¯t the only president to support the idea of banking over financial support. Then-President Bill Clinton introduced legislation with the aim of promoting ¡°community empowerment¡± via banking. Across party lines, then-Presidents George W. Bush and Barack Obama supported and upheld Clinton¡¯s infrastructure. Former President Donald Trump also made similar promises during his time in office.

Baradaran further argues that¡ªas it is nearly impossible for a segregated community to keep its wealth entirely self-contained¡ªBlack-owned banks may actually facilitate the flow of money out of African American communities and into the White economy.

Professor Mount sees it the same way. ¡°By emerging themselves within a White-governed capitalist marketplace, Black banks are facilitating the very extraction of wealth from the communities they purport to serve,¡± he says.

Black-Owned Banks: State-by-State Breakdown

While the number of Black-owned financial institutions may have declined from their peak, they cumulatively have a significant presence. As of Jan. 31, 2022, the 44 Black-owned banks and credit unions in the U.S. had approximately $9.12 billion in assets. And although 23 states had no Black-owned financial institutions within their borders, several organizations have a presence across the U.S. because of their partnerships with major automated teller machine (ATM) networks. Additionally, many of the Black-owned financial institutions in the country are not-for-profit credit unions.

The majority of Black-owned institutions offer both traditional brick-and-mortar branches and online/mobile services. Even OneUnited Bank, originally an Internet-only bank, now has multiple physical locations across the U.S. Ensuring online accessibility is a smart move considering that, in 2019, approximately 34% of African American consumers were more likely to use mobile banking as their primary method of accessing their accounts. Currently, Columbia Savings & Loan Association is the sole institution without any online or mobile banking services.

Below: a list of Black-owned banks and credit unions in the U.S., in alphabetical order.

1st Choice Credit Union

Founded in 1946, the Hospital Authority Credit Union was created to provide financial services to employees of Grady Hospital. In 1991, the organization became known as 1st Choice Credit Union.

- Branches: Auburn Avenue Administrative Office (Atlanta) and Grady Memorial Hospital (Atlanta)

- ATMs: Crestview Health & Rehabilitation Center (Atlanta) and Ponce De Leon Center (Atlanta)

- State: Georgia

- Services: Personal and business checking and savings, in addition to loans (personal, mortgage, etc.)

- Assets: $37.42 million

- Availability: Brick-and-mortar and online

Alamerica Bank

Alamerica Bank was originally organized by a group of prominent Birmingham, Ala., community leaders on Jan. 28, 2000. Alamerica achieved operational profitability after six months of operation.

- Branches: The Alamerica Bank Building (Birmingham)

- ATMs: N/A

- State: Alabama

- Services: Deposit services (business and personal accounts), loan services (commercial and personal loans), internet banking, image statements, and MasterMoney debit cards

- Assets: $15.42 million

- Availability: Brick-and-mortar and online

Brookland Federal Credit Union

Founded in 1999, Brookland Federal Credit Union is a not-for-profit financial cooperative that provides financial services to members of Brookland Baptist Church and their immediate family members. If you join Brookland Federal, you and your family have a lifetime membership.

- Branches: Brookland Federal Credit Union (West Columbia, S.C.)

- ATMs: Via PULSE? and STARS? networks

- State: South Carolina

- Services: Savings, checking, loans, and other services (financial literacy, guaranteed auto protection, etc.)

- Assets: $4.66 million

- Availability: Brick-and-mortar and online

Brooklyn Cooperative Federal Credit Union

Brooklyn Cooperative Federal Credit Union, also known as Brooklyn Coop, was originally founded in 2001. Joining Brooklyn Coop requires a piece of mail as proof of address, a government-issued photo ID, Social Security card or individual Tax Identification Number (TIN), and a $25 membership fee plus a $5 minimum savings account balance.

- Branches: Bedford-Stuyvesant Branch (Brooklyn, N.Y.), Bushwick Branch (Brooklyn, N.Y.), and Chestnut Branch (Brooklyn, N.Y.)

- ATMs: Any ATMs in the CO-OP network

- State: New York

- Services: Banking accounts (checking, savings, etc.), loans, and financial counseling and education

- Assets: $46.66 million

- Availability: Brick-and-mortar and online

Carver Federal Savings Bank

Carver Federal Savings Bank was founded in 1948 to serve African American communities with limited access to mainstream financial services. The majority of its branches and ATMs are located in low- to moderate-income neighborhoods. Carver Federal Savings Bank is one of the four banks that are considered Black-operated instead of Black-owned.

- Branches: Atlantic Terminal Branch (Brooklyn, N.Y.), Bedford-Stuyvesant ¡ª Restoration Plaza Branch (Brooklyn, N.Y.), Crown Heights Branch (Brooklyn, N.Y.), Flatbush Branch (Brooklyn, N.Y.), St Albans Branch (Jamaica, N.Y.), 125th Street Branch (Manhattan, N.Y.), and Malcolm X Boulevard Branch (Manhattan, N.Y.)

- ATMs: Atlantic Terminal Branch (Brooklyn, N.Y.), Bedford-Stuyvesant ¡ª Restoration Plaza Branch (Brooklyn, N.Y.), Crown Heights Branch (Brooklyn, N.Y.), Flatbush Branch (Brooklyn, N.Y.), St Albans Branch (Jamaica, N.Y.), 125th Street Branch (Manhattan, N.Y.), Malcolm X Boulevard Branch (Manhattan, N.Y.), and all ATMs in the JPMorgan Chase, Wells Fargo, and Allpoint networks

- State: New York

- Services: Personal and business banking, loans, and community cash

- Assets: $744.43 million

- Availability: Brick-and-mortar and online

Carver State Bank

Established in 1927, Georgia Savings and Realty Corp. was a small, private bank as well as a real estate investment and management company. By 1962, Carver had become a full-service commercial bank, thus its name was changed once more to Carver State Bank.

- Branches: Main Office (Savannah, Ga.) and Skidaway Branch (Savannah, Ga.)

- ATMs: Main Office (Savannah, Ga.), Skidaway Branch (Savannah, Ga.), and any ATMs in the Wells Fargo and MoneyPass networks

- State: Georgia

- Services: Personal accounts (checking and savings), business accounts, loans, development programs, and other services (cashier¡¯s checks, money orders, etc.)

- Assets: $82.67 million

- Availability: Brick-and-mortar and online

Citizens Bank

In 1904, originally founded as One Cent Savings Bank, Citizens Bank became the first minority-owned bank in Tennessee. Citizens Bank is the oldest continuously operating Black-owned bank in the U.S.

- Branches: Corporate Headquarters (Nashville, Tenn.), Main Office (Nashville, Tenn.), and Memphis Branch (Memphis, Tenn.)

- ATMs: N/A

- State: Tennessee

- Services: Personal and business banking (checking and savings), credit cards, and loans (personal, business, etc.)

- Assets: $173.44 million

- Availability: Brick-and-mortar and online

Citizens Trust Bank

In 1921, Citizens Trust Bank was created to serve the African American citizens of Atlanta. Today, the bank plays an active role in providing sponsorship support for multiple community organizations.

- Branches: Birmingham (Birmingham, Ala.), Eutaw Branch (Eutaw, Ala.), Cascade Branch (Atlanta), Corporate Headquarters (Atlanta), Westside Branch (Atlanta), East Point Branch (East Point, Ga.), Rockbridge Branch (Stone Mountain, Ga.), and Panola Branch (Stonecrest, Ga.)

- ATMs: Castleberry Inn ATM (Atlanta), Westside ATM (Atlanta), South Dekalb Mall ATM (Decatur, Ga.), Lithonia ATM (Lithonia, Ga.), Rockbridge Plaza ATM (Stone Mountain, Ga.), Stone Mountain ATM (Stone Mountain, Ga.), and Panola ATM (Stonecrest, Ga.)

- States: Alabama and Georgia

- Services: Banking (savings, checking, etc.) and borrowing (loans, credit cards, etc.) services

- Assets: $697.44 million

- Availability: Online and brick-and-mortar

City First Bank

City First Bank is a subsidiary of Broadway Financial Corp. that was founded in 1998. In 2021, City First Bank merged with Broadway Federal Bank to become the largest Black-led MDI in the U.S. and the one of two with more than $1 billion in total assets. City First Bank is also one of the four banks that are considered Black-operated instead of Black-owned.

- Branches: Exposition Park Branch (Los Angeles), Inglewood Branch (Los Angeles), and Branch & Corporate HQ (Washington, D.C.)

- ATMs: Exposition Park Branch (Los Angeles), Inglewood Branch (Los Angeles), and Branch & Corporate HQ (Washington, D.C.), in addition to any ATMs in the MoneyPass network

- Locations: California and Washington, D.C.

- Services: Personal and business banking (checking, savings, etc.), small business finance, and cash management

- Assets: $1.24 billion

- Availability: Brick-and-mortar and online

Columbia Savings & Loan

Columbia Savings & Loan has served Milwaukee¡¯s inner city, particularly its growing minority population, since 1924.

- Branches: Columbia Savings & Loan Association (Milwaukee)

- ATMs: N/A

- State: Wisconsin

- Services: Mortgages, church loans, certificates of deposit (CDs), and individual retirement accounts (IRAs)

- Assets: $27.80 million

- Availability: Brick-and-mortar only

Commonwealth National Bank

Founded in 1976, Commonwealth National Bank is a full-service nationally chartered commercial institution. Commonwealth is the sole bank headquartered in Mobile, Ala., out of the 45 banks doing business there. In addition to being the only MDI in Mobile, it is one of two in Alabama.

- Branches: Main Office Branch (Mobile) and Crichton Branch (Mobile)

- ATMs: Main Office Branch (Mobile), Crichton Branch (Mobile), any Publix Super Market ATM, and any PNC Bank ATM

- State: Alabama

- Services: Consumer and business services, in addition to loans

- Assets: $67.07 million

- Availability: Brick-and-mortar and online

Credit Union of Atlanta

Founded in 1928, the Credit Union of Atlanta remained stable and secure throughout the Great Depression. Any profits earned are used to secure better rates for the institution¡¯s members.

- Branches: Main Office (Atlanta) and Pryor Street Lending Center (Atlanta)

- ATMs: Atlanta Detention Center (Atlanta), Atlanta Public Safety Annex (Atlanta), Credit Union of Atlanta (Atlanta), and Pryor Street Lending Center (Atlanta), in addition to any ATMs in the MoneyPass and STAR networks

- State: Georgia

- Services: Personal savings and checking, business checking, credit builder and personal loans, and payment protection

- Assets: $79.37 million

- Availability: Brick-and-mortar and online

Faith Community United Credit Union

Originally chartered in 1952 as Second Mount Sinai Baptist Church Credit Union, Faith Community United Credit Union became a Community Development Credit Union (CDCU) in 1991. Faith is one of the largest minority-owned credit unions in Ohio, and it is available to anyone who lives, works, worships, or attends school in Cuyahoga County, as well as their family, business, and organization. Membership is also possible through a Select Employee Group (SEG).

- Branches: Faith Community United Credit Union (Cleveland)

- ATMs: N/A

- State: Ohio

- Services: Deposit services, loan services, insurance, and other services

- Assets: $16.94 million

- Availability: Brick-and-mortar and online

Faith Cooperative Federal Credit Union

The story of Faith Cooperative Federal Credit Union is a tale of two different organizations. St. John Federal Credit Union was founded in 1959. It became known as Faith Cooperative Federal Credit Union after it was integrated with Friendship-West Baptist Church¡¯s vision of a microloan bank.

- Branches: Administrative Offices (Dallas)

- ATM: One located ¡°near the Banquet Hall¡±

- State: Texas

- Services: Savings, loans, and gap protection

- Assets: $2.07 million

- Availability: Brick-and-mortar and online

FAMU Federal Credit Union

On May 8, 1935, six individuals were convinced to deposit $50 to acquire a federal credit union charter, resulting in the founding of Florida A&M College Employees Federal Credit Union. By 1953, the organization renamed to Florida A&M University Federal Credit Union due to its location on the FAMU campus.

- Branches: Office (Tallahassee)

- ATMs: One located in the ¡°first drive-thru lane¡± as well as any ATMs that are part of American Express, CULIANCE, The Exchange, Honors, Member Access, Plus, Presto, Publix, Walmart, and ¡°other credit unions with the participating listed networks¡±

- State: Florida

- Services: Accounts (checking, savings, money market accounts), Rattler debit and VISA credit cards, loans, wire transfers, and other services (notary services, bill payments, etc.)

- Assets: $29.77 million

- Availability: Brick-and-mortar and online

Financial Health Federal Credit Union

Financial Health Federal Credit Union has been serving its local community, which is more than 10,000 Indianapolis members strong, since 1971. Membership is limited to employees of Indiana University (IU) Health and its affiliates as well as individuals who live, work, worship, or attend school in one of 12 Indianapolis ZIP codes.

- Branches: IU Health West Hospital (Avon, Ind.), East Branch (Indianapolis), Indianapolis Urban League Branch (Indianapolis), IU Health Medical Tower (Indianapolis), and Sunstone Branch (Indianapolis)

- ATMs: IU Health West Medical Center (Avon, Ind.), IU Health North Medical Center (Carmel, Ind.),?East Branch (Indianapolis), Indianapolis Urban League Branch (Indianapolis), IU Health?University Hospital (Indianapolis), Methodist Hospital (3) (Indianapolis), and Sunstone Branch (Indianapolis), in addition to any ATMs in the Alliance One network)

- State: Indiana

- Services: Deposit accounts (checking, savings, etc.) and loans (personal, auto, etc.)

- Assets: $36.36 million

- Availability: Brick-and-mortar and online

First Independence Bank

In business since May 11, 1970, First Independence Bank has served the Detroit metropolitan area for 50 years. First Independence is the sole African American©owned bank headquartered in Michigan, in addition to being one of two banks headquartered in Detroit.

- Branches: Main Office Branch (Detroit), Seven Mile Branch (Detroit), Lake Street Branch (Minneapolis), and University Branch (Minneapolis)

- ATMs: Clinton Township (Clinton Township, Mich.), 1st Floor International Building (Detroit), City County Building (Detroit), Livernois (Detroit), Main Office Branch (Detroit), Seven Mile Branch (Detroit), Lake Street Branch (Minneapolis), and University Branch (Minneapolis), in addition to any ATMs in the FIB, Fifth Third Bank, Huntington National Bank, U.S. Bank, JPMorgan Chase Bank, Bank of America, Wells Fargo Bank, and Bremer Bank networks

- State: Michigan and Minnesota

- Services: Consumer and business services, in addition to loans

- Assets: $601.78 million

- Availability: Brick-and-mortar and online

First Legacy Community Credit Union

The School Workers Federal Credit Union was founded by a group of educators in Feb. 14, 1941. On Jan. 1, 2020, First Legacy Community Credit Union merged with Self-Help Federal Credit Union and now operates as a division of Self-Help.

- Branches: Apopka Branch (Apopka, Fla.), DeLand Branch (DeLand, Fla.), Jacksonville (Kendall Town) Branch (Jacksonville, Fla.), Jacksonville (River City) Branch (Jacksonville, Fla.), Jacksonville (Westside) Branch (Jacksonville, Fla.), Jacksonville Downtown (JEA Tower) Branc

Leave a Reply