ACH Transfers vs. Wire Transfers: An Overview

Sending cash out of your checking account electronically is more and more handy, simple, and low-cost. Two methods to take action are automated clearing home (ACH) transfers and wire transfers. ACH is extensively utilized in some ways, and infrequently low-cost or free. Wire transfers might be quicker (however value extra) than ACH, and can be utilized for home and worldwide cash transfers.

Key Takeaways

- Automated clearing home (ACH) and wire transfers are each sorts of digital fund transfers when sending cash or paying payments electronically.

- By way of pace, wire transfers often course of faster than ACH transfers and could also be used for worldwide transfers, however you could be charged a price to ship or obtain cash.

- ACH funds are usually free and turning into quicker.

- Figuring out when to make use of ACH or a wire switch can depend upon the rationale for sending or receiving cash and the urgency to finish the transaction.

| ACH | Wire | |

| Transaction Kind | Invoice pay, P2P, receiving paychecks | Home closing, automobile purchases, sending cash to pal and household abroad |

| Vacation spot | Home | Home and worldwide |

| Velocity and Timing | Decrease quantities, versatile deadlines | Bigger quantities, tight deadlines |

| Price and Charges | Free to low value to ship; few charges | Charges to ship vary between $25-$50 |

| Limits | Range, however could also be decrease | Excessive limits |

| Fraud | Much less frequent fraud goal | Frequent fraud goal |

| Reversal | Potential | Very tough to inconceivable |

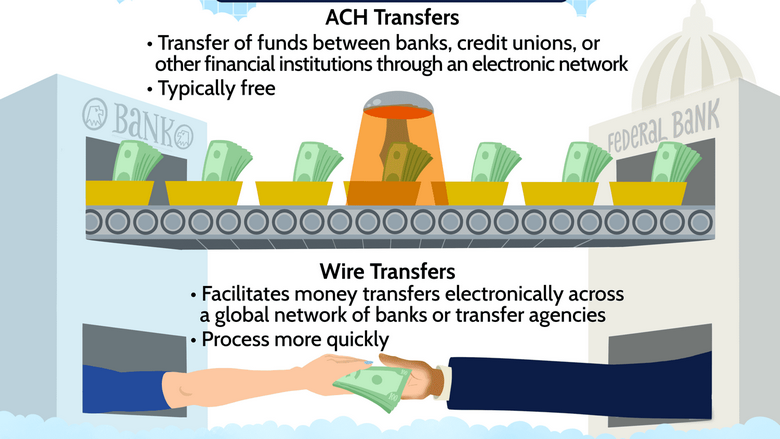

ACH Transfers

An ACH transaction entails the switch of funds between banks, credit score unions, or different monetary establishments by way of an digital community. Any such switch is used for a lot of functions, together with processing:

- Paycheck direct deposit

- Direct deposit of presidency advantages or tax refunds

- Recurring debits (comparable to computerized invoice funds)

- One-time invoice funds

- Worldwide funds

- Purchase now, pay later (BNPL) funds

- Healthcare declare funds

- Individual-to-person (P2P) funds comparable to PayPal, Venmo, and Zelle

- Enterprise-to-business (B2B) funds

Most shoppers use ACH to pay payments and ship cash person-to-person funds as a result of it’s free for the usual switch for a period of 1 to three days within the US. Banks and third-party apps comparable to Venmo, PayPal, and Zelle depend on ACH to maneuver cash between family and friends or, in some instances, pay payments. ACH has additionally been embedded in lots of high-profile fintech fee apps, comparable to Stripe for shopper to service provider pay and for enterprise to enterprise funds.

In whole, roughly 7.7 billion same-day ACH funds totaling $19.7 trillion have been processed within the second quarter of 2022.

How ACH Transfers Work

An ACH transaction has a number of transferring elements. How ACH transfers work can depend upon whether or not the transaction entails a direct fee or a debit.

In easy phrases, the originator or first financial institution initiates an ACH switch, which is grouped with different ACH transfers. These transactions are processed by way of the clearing home. As soon as transfers are processed for the day, they¡¯re despatched in batches to the receiving financial institution. The receiving financial institution then credit or debits the suitable accounts accordingly.

ACH can also be often known as or known as direct deposit, direct debit, test, EFT, and digital financial institution switch.

ACH Switch Instance

Your bank card invoice must be paid each month, so that you schedule a recurring card fee by way of your financial institution.

You log in to your on-line checking account or cell banking app and authorize the fee to your bank card firm. The bank card firm turns into the transaction’s originator.

The bank card firm sends a file with the upcoming fee particulars to its financial institution. The fee is processed by way of the ACH operator. The ACH operator sends a file with the fee request data again to your financial institution, which is the receiving depository monetary establishment.

Your financial institution sends the fee to the bank card firm as scheduled. On this transaction, you’re on the receiving finish of a fee request.

For an ACH transaction to be processed, there should be adequate funds within the account. In any other case, the fee or switch might be returned, which may set off a price. As well as, ACH transfers can take longer to finish as a consequence of anti-fraud protections.

Wire Transfers

A wire switch is a transaction initiated by way of a financial institution transferring funds from one account to a different at an exterior financial institution. When each banks are within the U.S., that is referred to as a home wire switch. When one financial institution is outdoors the U.S., that is known as a global wire switch or a remittance switch.

Wire transfers are usually used to ship giant quantities of cash shortly. For instance, you could be requested to ship your down fee funds through wire switch if you happen to're shopping for a house. You may ship a wire switch by way of your financial institution, credit score union, or a enterprise like Western Union or MoneyGram.

When you're wiring $15 or extra to a international account from the U.S., this is named a remittance switch. Remittance transfers or worldwide wires despatched by way of a remittance switch supplier?have particular shopper protections, together with the fitting to cancel inside half-hour and the fitting to resolve errors.

How Wire Transfers Work

With wire transfers, banks talk instantly to maneuver funds between accounts. The particular person sending a fee supplies the financial institution with particular particulars, together with:

- The switch quantity and account quantity you are transferring from

- The recipient’s title, tackle, and cellphone quantity

- The recipient’s account quantity and monetary establishment’s wire switch routing quantity (which can be completely different than the standard routing quantity) or SWIFT code for worldwide wire transfers

- The recipient financial institution’s bodily tackle

As soon as the financial institution has this data, it may possibly course of the wire switch to deduct the requested quantity from the sender¡¯s account. This quantity is then credited to the recipient¡¯s account.

The particular person sending a wire switch pays a price, and federal legislation doesn't restrict the financial institution charges charged for wires.

As soon as a wire switch fee is shipped and accepted, the transaction can’t be reversed.

Wire Switch Instance

Say you¡¯re shopping for a house, and the quantity due at closing is $42,000. Lenders usually request that debtors wire their funds for the closing prices.

You name your financial institution to make sure you convey what's requested. You're instructed you have to make the wire request in particular person by 3 p.m., and produce proof of your identification. You go to your financial institution and supply the recipient¡¯s title, financial institution, account data, and every other data your financial institution requests.

The financial institution deducts $42,000 out of your cash market financial savings account and wires it to the recipient¡¯s financial institution. The financial institution prices you a $35 price for the switch. In the meantime, the cash is credited to the recipient¡¯s account inside a few hours.

Investopedia / Ellen Lindner

Key Variations Between ACH and Wire Transfers

Listed here are basic key variations between ACH and wire transfers. Nonetheless, specifics can range significantly by account sort and monetary establishment. Banks and credit score unions might have completely different choices or strategies for transferring money, significantly internationally.

Transaction Kind

The ACH community is mostly used for invoice funds, sending cash to associates, transferring cash between your accounts, receiving direct deposits on your paycheck, authorities advantages, or tax refund.

Alternatively, wires are sometimes used when working with tight deadlines or giant quantities, comparable to with actual property transactions, automobile purchases, or federal tax funds. They're additionally used for worldwide money transfers.

Vacation spot

ACH is mostly used for home money transfers inside the U.S., in or on a U.S. army base, U.S. embassy, and U.S. territories (Virgin Islands or American Samoa). Some worldwide ACH transactions (IATs) could also be potential relying in your financial institution or vacation spot, however they're not but widespread.

Wires might be despatched wherever within the U.S. or abroad besides to nations topic to U.S. sanctions, together with Cuba, Iran, and North Korea. Nonetheless, some on-line banks don’t provide the choice to ship cash by wire internationally, solely domestically.

Velocity and Timing

A home wire switch might be processed with cash arriving the identical day, typically in a number of hours. Nonetheless, you have to meet deadlines to learn from same-day processing, usually no later than 3 p.m. Japanese Time. Worldwide wires typically can take longer to ship¡ªas much as 7 to 10 days.

ACH transfers are usually scheduled between the next day or as much as three days later. However same-day or nearly quick can also be potential in some conditions. Deadlines for sending cash are usually later within the day and night.

Price and Charges

Your financial institution won’t usually cost you for sending or receiving ACH transfers. Even when charges are charged, they are usually decrease than wire transfers.

Nonetheless, that doesn't imply you gained't ever pay charges. Normal charges embrace a $30-$35 NSF price for inadequate funds, charged every try. You may additionally be charged a small price, comparable to $5 if you happen to get assist putting the ACH over the cellphone versus on-line.

Compared, sending a wire switch tends to come back with excessive charges:

- Exterior home wire transfers: Between $25 and $30

- Exterior worldwide wire transfers: Between $35 and $50

- Inner wire transfers (cash coming to you): Free to $15

You could pay decrease wire charges with credit score unions and on-line banks, and a few status financial institution accounts waive prices related to wires.

Limits

The sum of money you ship by ACH or wire could also be restricted by day, month, account, or methodology of switch.

Generally, wires have larger switch limits, however you could have to name on the cellphone or go to a department in particular person to make a switch. For instance, you may solely be capable to ship as much as $500,000 to a title firm for a house buy on-line, however there's no restrict if you happen to go to a department or name in.

ACH transfers are inclined to have decrease limits, however a lot relies on whether or not you're paying a invoice, sending cash to a different particular person, or sending cash to an externally linked checking account. You'll seemingly have larger limits if sending cash to a linked account.

Fraud

Each ACH and wire transfers are safe however weak to scams. Extra scammers are utilizing ACH fraud to divert direct deposits from authorities entities.

However traditionally, scammers used wire fraud to focus on unsuspecting victims. For instance, you could obtain an e mail telling you that you just¡¯ve gained a contest, however to assert the cash, you have to first pay a processing price utilizing a wire switch. You wire the cash, solely to obtain nothing in return as a result of the competition by no means existed.

Reversals

Usually, wires can’t be reversed or stopped, and you can not retrieve funds despatched by wire after approval. So you could face enhanced safety strategies, comparable to requiring proof of your identification and request.

Nonetheless, there are quite a few methods an ACH might be stopped, reversed, or canceled, in sure circumstances, comparable to duplicate funds or an incorrect fee quantity.

What Is the Distinction Between ACH and Wire Transfers?

An ACH switch is accomplished by way of a clearing home and can be utilized to course of direct funds or direct deposits. Wire transfers enable for the direct motion of cash from one checking account to a different, usually for a price.

How Protected Are ACH Transfers?

ACH transfers are regulated and designed to forestall fraudulent transactions. They will also be safer than licensed checks, cashier¡¯s checks, or private checks. It¡¯s essential, nevertheless, to provoke ACH transfers or obtain them solely from trusted entities.

Are There Charges for ACH and Wire Transfers?

Usually, ACH transfers¡ªtogether with on-line invoice funds and direct deposit of paychecks¡ªare free, whereas banks usually cost charges for home and worldwide wire transfers.

The Backside Line

Each the ACH and wire switch strategies have deserves. Figuring out which is greatest relies on your explicit wants, the kind of fee you¡¯re making, and any necessities you have to meet.

Two main variations are pace and price. Wire transfers are despatched individually and faster than ACH transfers, that are dealt with in batches. Lenders might require you to wire your down fee or closing prices.

Nonetheless, this additional pace comes at a value. ACH transfers are usually free or low-cost, whereas wire transfers can value wherever from $25 to $50.

In different phrases, a wire switch is your only option f it’s good to make an pressing fee or switch cash abroad, Conversely, for home funds that may wait a number of days, ACH transfers often make extra sense. Nonetheless, you possibly can ask your financial institution if worldwide ACH is offered for the nation you're sending to.

Leave a Reply